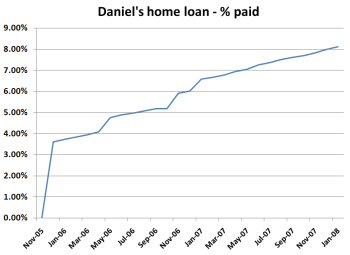

Checked the other day how much of my home loan I’ve paid off. It’s currently sitting at 8.13% gone, up from 6.59% this time last year, and it’s only shifting at about 0.11% per month (unless I choose to pay extra). Slow going. So much for my NY resolution in 2006 of trying to pay off 20% by the end of that year.

Checked the other day how much of my home loan I’ve paid off. It’s currently sitting at 8.13% gone, up from 6.59% this time last year, and it’s only shifting at about 0.11% per month (unless I choose to pay extra). Slow going. So much for my NY resolution in 2006 of trying to pay off 20% by the end of that year.

Some will say that buying a house doesn’t make economic sense; that renting is overall a better option. When I see the home loan statements, with the humongous amount of interest being charged, I can see that point of view.

But my sister pointed out the other day that it’s pointless looking at it like that. Money lost in interest is just part of the cost of having the house. I guess you could compare it to rent — in those terms, my loan payments are about double what I was paying in rent.

Wait a sec. If you took into account the full proposition, all the money going in, going out, and the how the property value is appreciating, how does it all add up?

So I did a few quick calculations. Thanks to the booming house prices in my area, I’m actually making a huge profit every month. In fact the expenses of loan payments and interest are outweighed 3:1 by the current (estimated) monthly appreciation on the house. Even if prices were rising half as fast, I’d still be ahead.

It’s worth noting that one of the criteria the Buyers Advocate used was that the house would be a good investment — along with all the other factors such as location and affordability and something I liked.

So while it’s money I’ll never see (I’m determined to avoid ever moving house again, cockroaches or no cockroaches), it’s certainly all piling up. That’s cheered me up no end.

9 replies on “Home economics”

Just out of interest, take a look in your current area and the last area you lived in on realestate.com.au for a place you would be able to rent. I can guarantee the rental cost has gone up also. I agree with Susannah and think you are way better off paying your mortgage.

When I started reading this entry I was expecting something completely different. At school Home Economics was cooking class so I thought you were going to share a favourite recipe or an amusing anecdote from a cooking fiasco.

It was still interesting though. I know I look at the current market value of our house and am astounded. Fingers crossed it stays that way!

Mary-Ellen

in my parents’ day, school cookery was called domestic science. In my day, it was home economics. My older child is studying “food technology” and comes home with yummy food she’s cooked at school.

PS I think Daniel’s prominent chart gave the game away!!

Rog.

Home economics at my school was called ‘Management and Family Living’.

But back on topic, one thing to cheer you up is that 0.11% per month is NOT a constant. The early payments are mostly interest. But with every payment a larger proportion reduces the principal a bit more than the last one. So although this point might take 15 years (less if you make extra payments), the majority of the payments will eventually cut the principal owing and thus directly boosting your equity :)

Though the decision to make extra payments depends on available funds and opportunity cost. In your case it’s probably wise; in mine it probably isn’t.

BTW the comment about renting making more economic sense (promulgated by Phil Ruthven) is only correct if people invest the difference sensibly. If they just spend it they’ll end up broke.

The decision to buy a home is forced saving; for the majority of the population no other way will work, and the proportion who managed long-term unforced saving AND invest it sensibly to build a sizeable portfolio (ie worth more than the average suburban house) is very small.

So for most people buying a home is as close to certainty as they can get – if they can manage the payments they’ll end up with a usable asset.

The biggest predictor of wealth in Australia is neither the usual suspects of job income, occupational category or education.

Rather it is housing tenure (owner/buyers are on average 10 times wealthier than tenants). This is followed by age (older = richer with wealth peaking around 60) and relationship to the labour market (both working or retired people are several times wealthier than the unemployed.

Hence the poorest households in Australia are singles under 35; the richest are couples over 60. Most of the former don’t own their homes, while the latter do. Hence two or three important factors coincide, making 20:1 wealth differences not unusual ($500k – $1m average household wealth for a 60 year old couple is very average now, whereas a non-home-owning 30 year old might have $20-50k if they’re lucky).

I’m interested to know how you made your chart – was it your own spreadsheet, or something available on the internet? Do I have the patience to play with something like that? And do I really want to know?!

Rae, good point. Even straight after I moved out, the rent on my old place went up by $10/week.

Peter, yeah, I suspect I’d have little luck saving money while renting.

Jen, it’s just comparing the current balance each month vs the original loan amount, as a per cent, and graphed in Excel.

Daniel – I know it is different in Victoria (in particular) because of the enormous transfer duty you guys pay (and the higher value generally of the house to start with) but…

My wife and I have made most of our money by buying and selling – not by hanging on forever. Not buying low and selling high (because then you end up with nowhere to live when you sell high and there is no low!) but by buying sensibly (based on anticipated resale etc). My first house was $110k – 2 bed, 1.5 bathrooms, no garage – a townhouse in fact. We barely made the payments and had to pay mortgage insurance because we couldn’t scrape together 20% of $110k!

Our latest purchase (5 purchases and 15 years later) is a little over 7 times the price, with us paying more than 20% as a deposit – no mortgage insurance.

I have always been an advocate of borrowing close to as much as is comfortable (particularly early in life) because as wages move up, repayments stay relatively the same (albeit interest rates sometimes have an impact). Our first house saw us eating baked beans more often than could have been healthy!

But we now “own” almost $200k of our house – which has “increased” by more than $100k since we bought it 12 months ago. So effectively we own about $300k of our house. As long as you buy with the intention of staying long enough (at least) to make some decent capital growth, and you can do some work to the place (even just improving gardens etc), then you are almost assured of making money in the medium term.

And I agree with Peter’s first comment about the 0.11% not being constant – the nicest thing is to watch that drop each year or so, and watch the principal grow.

Buying my condo (1 bedroom, 1.5 bath apartment in North Miami Beach, FL) was by far the best financial decision I have ever made.(Think its called a unit in Australia??) My mortgage and condo fees combined each month are less than half what it would cost to rent a similer place in the Skylake area. It has quadrupled in value in the 11 years that I have owned it. When I sell it soon I will have a handsome profit to buy my next place. When my brother moves out of his place that he has rented in Chicago for 14 years he will get his security deposit of 1 month’s rent back.