(Not a transport post) If you’re looking on the shelf for something at Bunnings and you can’t find it, in some aisles there’s a secret door that might help.

Category: Consumerism

Foolish lockdown purchases

Forgive me for this indulgence. No transport stuff in this post – try this link if that’s what you’re looking for. I started writing this post in 2020 after my sons moved out, adding to it every few months. The space in the house after they left plus lockdowns plus online ordering resulted in some ... [More]

Switching from Android to iPhone

Not a transport post. After much dithering, I’ve made the switch to iPhone. I’ve used Android phones for ten years. If I’m honest a lot of that was due to the price. Midrange Android phones seemed like better value for money. But they also have a short life. 2 years then you replace them because ... [More]

Vacant shops

At long last the shops built as part of the new Bentleigh station (my local) have been leased. Somewhat to my surprise, in the middle of an economy-busting pandemic, they’re being fitted out now. One of them will be a medical centre. Following a conversation on Twitter about it, I was curious to see if ... [More]

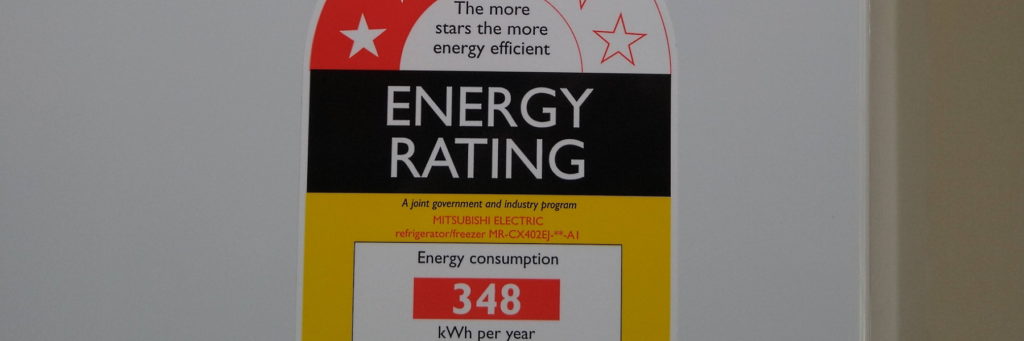

The new fridge

Amongst all the chaos in the world, a everyday standard curve-ball thrown my way: my fridge broke down on the weekend. Okay – drag out the esky and buy a bag of ice (no I’m not going to a party) and save what food I can. Lucky I’m not a big hoarder of food, so ... [More]

The wave of climate protests (the Climate Strike a few weeks ago, and to a lesser extent the Extinction Rebellion last week) are a good reminder that although our current political masters (especially at the Federal level in Australia) are keen to do nothing, pretty soon a large mass of people who want action will ... [More]

Retail therapy

Just a quick few points while I work on a more complicated post that’s (inevitably) transport related… Shopping bags Many major retailers are phasing out single-use plastic bags. Or to be precise, they’re phasing-out free bags. Woolworths: 20/6/2018 Coles, Target, Big W: 1/7/2018 Aldi never gave away bags. K-Mart is phasing out free bags during ... [More]

ATMs are free – but not all of them

Believe it or not, sometimes I blog about things other than transport. If you want to look purely at transport posts, try this link. Commonwealth Bank (CBA) announced on 24th September that all their ATMs were free for use by customers of any Australian bank. The same day, the rest of the Big 4 scrambled, ... [More]

As you grow older, you find yourself doing things you genuinely had no idea you’d be doing. At least I do. Perhaps other people have all their plans worked out way further in advance. When I was growing up, we had little money, and I couldn’t dream of owning my own home. At age 30 ... [More]

New phone: Motorola G5 Plus

A reminder that despite how it may sometimes seem, not all my blog posts are about transport. If you want to view only the transport posts, try here. For convenience, this link is also on the menu at the top, under Transport. Over the years I’ve had many mobile phones. Here’s an update to that ... [More]

I don’t have “get rich quick” schemes. I kind of have “get moderately well-off, gradually” schemes. The worst one has been buying shares. I got a tip that shares in Xero (the online accounting software company) would skyrocket. And they did, from about $6 to something like $40. But that was before I got around ... [More]

A couple of years ago I got a ceiling fan fitted in the kitchen. The electrician was pleasant, competent, and did a good job. He said he’d send me an invoice. He never did. A couple of months later I emailed him and asked him to send it. He acknowledged the email and said he’d ... [More]